Users are Losing Billions of Dollars

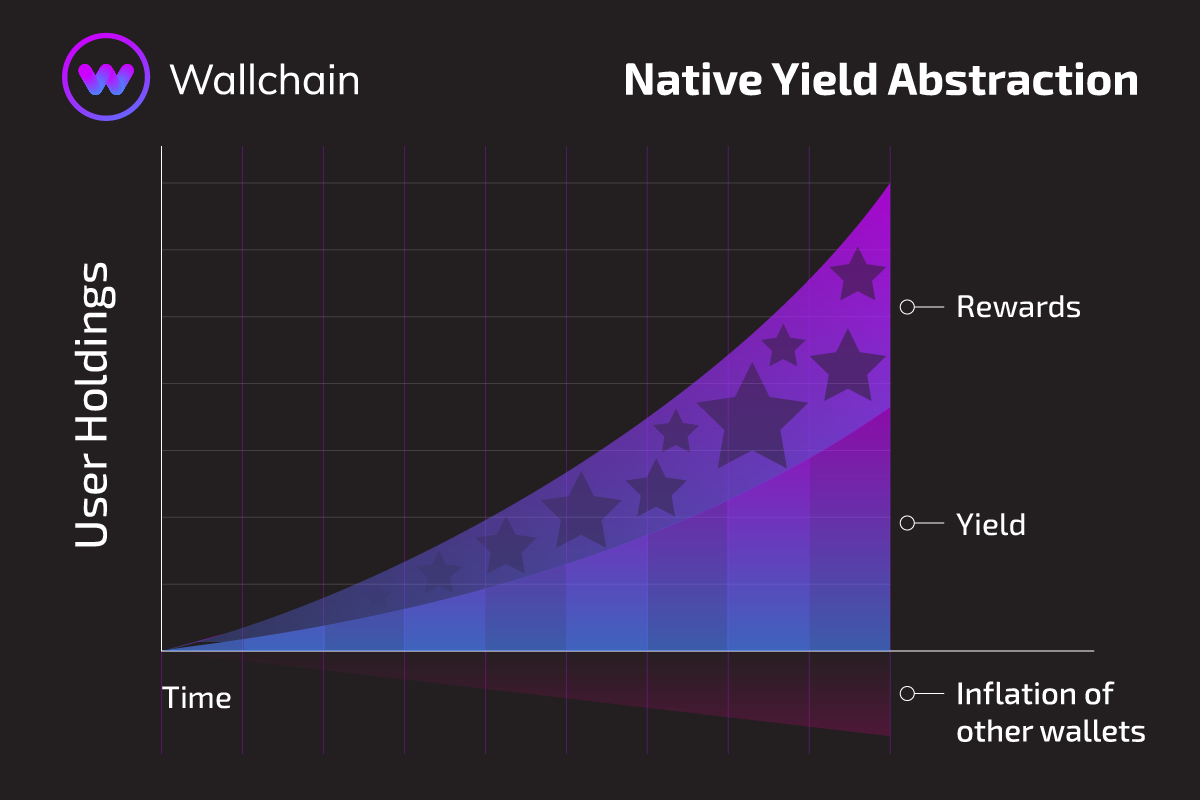

While being inflationary assets, ETH, SOL, and stablecoins offer a 4-8% yield. By simply holding these assets, users are losing money to a form of inflation and yield opportunities.

Balance compounds automatically, and earns rewards on top

Monetization Step-up for Wallet Providers

One of the primary challenges for wallet providers is limited monetization options. Typically, revenue streams are confined to swap and on/off-ramp fees, overlooking the potential of idle assets. Yield-bearing wallet infra transforms these idle assets into a yield-generating mechanism akin to traditional banking deposits, thereby unlocking a substantial monetization channel with minimal integration effort and reduced risk.New Business Model for Wallets and Apps

This yield makes it possible to create new business models for wallets, dApps, and games that are not yet possible. DApps can offer zero trading fees or even pay for user gas thanks to monetization through user’s yield. Conventional yield generation uses platforms connected to user wallets, with aggregators providing pre-designed optimization paths. Aggregators are subscription services integrating with users’ externally owned accounts (EOAs) to scan for opportunities. In contrast, native yield abstraction (NYA) is an account abstraction (AA) technique allowing users to program custom operations within their wallets. These customizations interact with external protocols or smart contracts based on user-defined conditions, automating yield generation natively within the wallet.Funds Are Always Accessible

Yield generation is fully automated through Account Abstraction, enabling the automatic depositing and withdrawal of holdings. This ensures funds are readily available for immediate use when needed. The system intelligently determines the optimal moments for depositing and withdrawal based on a variety of parameters.Seamless Operations: An Example

1

Initiate the Transaction

A user decides to exchange 1,000 USDC for WETH. This action is triggered

within the wallet, drawing from the user’s 10,000 USDC balance, which

was previously deposited through our automatic yield protocol.

2

Withdrawal

The Native Yield Abstraction system seamlessly orchestrates the

withdrawal of 1,000 USDC needed for the transaction. This step is automated,

requiring no manual intervention from the user.

3

Exchange and Re-depositing

Following the withdrawal, the exchange of 1,000 USDC for WETH is performed.

Once the transaction is complete, the remaining balance continues to earn

yield, as the system automatically deposits it back. This entire process is

designed to be smooth and unnoticeable, ensuring a fluid user experience.

This process is designed to be so smooth that it becomes virtually unnoticeable

during regular wallet interactions, ensuring a fluid user experience without

the hassle of manual asset management.

- Continuously deposited holdings, maximizing their yield potential.

- Compounded earnings, enhancing their return on investment.

- The assurance that their money is passively working for them, even while they actively engage with their wallet, providing both peace of mind and financial benefits.